Option Tales: Cheap Options Part II

| 24-05-2016 | Rob Söentken |

Today in Rob Söentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which will be discussed in four articles. In the previous article I talked about the first two solutions: Choose the strike further OTM and Choose shorter tenor. Today I will be discussing the next two solutions: Choose the longer tenor and the Compound option.

Today in Rob Söentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which will be discussed in four articles. In the previous article I talked about the first two solutions: Choose the strike further OTM and Choose shorter tenor. Today I will be discussing the next two solutions: Choose the longer tenor and the Compound option.

3- Choose longer tenor

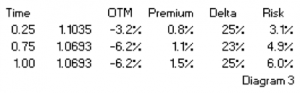

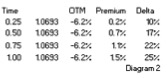

Following the comparison between a 3-month and a 12-month option, it should be remembered that a 12-month option will have some remaining value after 3 months have passed, at least theoretically. If we assume ‘ceteris paribus’ (everything remained unchanged) the remaining option value of a 12-month option would be 1.1%. If we  bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes.

bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes.

4- Compound option

A compound option is the right to buy an option against a certain premium. For example we could be considering to buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

An alternative to the compound option would be to buy the 3-month option for 0.2%. On expiry, assuming nothing has changed again, we could buy a 9 month option in the market for 1.1% (see diagram 2).

In my next two articles I will discuss the last two solutions for minimizing premium expenses when buying options:

- Conditional Premium option

- Reverse Knock Out

Would you like to read more in Rob Söentken’s Option Tales?

1. Options are for wimps

2. ATM or OTM

3. Cheap options part 1

Ex-derivatives trader