Bound

Bound provides modern currency hedging technology that is a hassle-free, transparent and cost effective alternative to traditional FX brokers and banks.

Who we are:

We’re on a mission to help companies grow efficiently, win the best customers and hire the best talent internationally…

… without having to think about exchange rates.

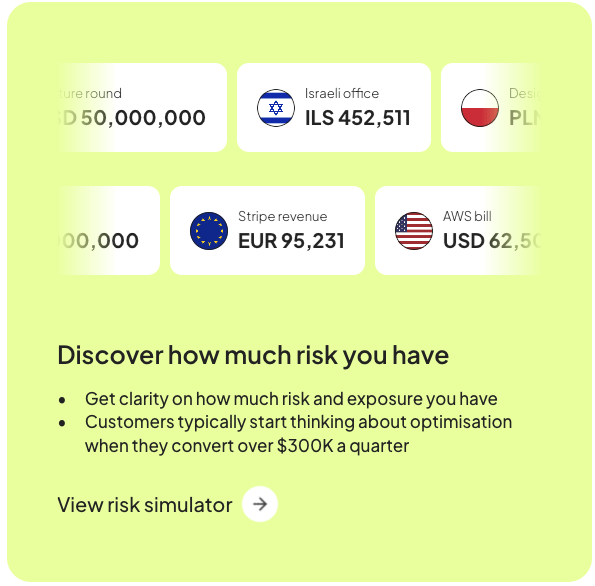

Since beginning in 2022, we have already helped 100s of customers safely transact 700M+ in conversions and hedges, enabling them to manage their currency risk and protect their cash flows.

Why finance and treasury teams choose Bound:

“It’s just so easy” ~ Workflow Security

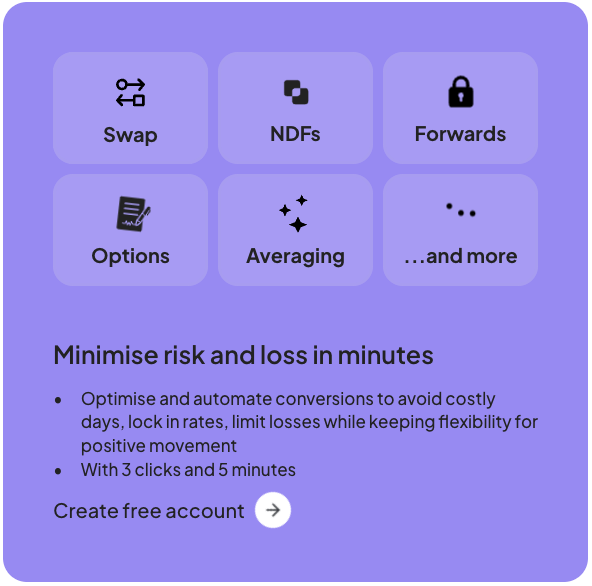

- A simple streamlined user experience is a priority at Bound

- Optimise and automate conversions and hedging strategies in as little as 3 clicks and 5 minutes

“It’s the best rate I could find on the market” ~ Smart Marketing Automation

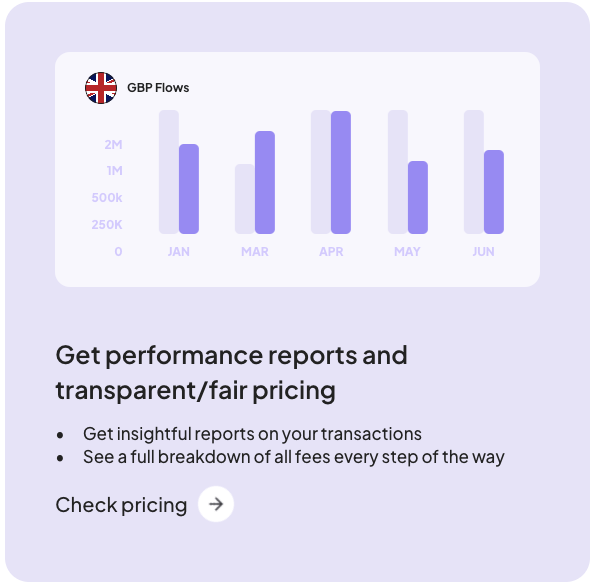

- Transparency and fair pricing is a non-negotiable

- Get insightful reports on your transactions

- See a full breakdown of all fees every step of the way

“We changed our hedges in like, 2 minutes” ~ Collaboration tools

- Experience unrivalled flexibility

- Easily change amounts and settlement dates as needed without hidden fees

Bound Rates Limited (FRN 966723) is authorised and regulated by the Financial Conduct Authority to act as an Investment Firm.

Follow Bound

Minimising currency risk doesn’t have to be hard or expensive

Stay up to date with our blog covering all things currency

Customer testimonial video

LEADERSHIP TEAM

BOUND IN THE NEWS

Next-Gen CFOs Need Next-Gen Tools to Power Their Organizations

Trend spotter:

Fintech predictions

Looking ahead at fintech’s future and unveiling our Fintech 100 EMEA

Europe’s fintech startups to watch

The Bound Founder Story: Qualifying, Quantifying and Managing FX Risk

Bound selects Integral for multiple source FX liquidity aggregation

FX Hedging for Beginners: Reduce Foreign Currency Risk

16-12-2024 | This blog from Bound explains FX hedging as a currency risk management strategy companies use to protect against losses due to fluctuations in exchange rates.

Two sides of one coin: Hedging vs. Speculation

11-11-2024 | Over the last couple of years, Bound has spoken to hundreds of venture backed tech companies that have a continuous requirement to convert their currencies.

Recap & Recording: Tech-Driven FX Risk Management, Smart Moves for Financial Leaders

06-11-2024 | The session focused on FX management tech, highlighting the need for precise data, the challenges of FX risk, and the impact of automation and AI in optimizing treasury operations.

FX: Is hedging expensive?

5-11-2024 | Hedging foreign exchange risks is often perceived as expensive. However, this blog by Bound argues that the costs are minimal.

Live Session: Tech-Driven FX Risk Management, Smart Moves for Financial Leaders

21-10-2024 | We are excited to invite you to join our upcoming live session in cooperation with our partner BOUND on October 29.

FX Hedging that is flexible enough for the real world

03-10-2024 | Many companies don’t want risk to exchange rates