5 steps for optimizing payment transactions

| 13-09-2018 | TIS | treasuryXL |

They are one of the most important economic transactions and since all times have provided us with order and structure, but at the same time they have been a nuisance, because they are equally complex and essential. They come in the form of cash payments, semi-cash payments and non-cash payments, with the latter definitely at the forefront. But in order to organize payment transactions optimally, there are a few things that need attention.

In this article you will find out everything on how to renew your payment transactions, making them more transparent, simpler and more secure. At the same time, you can keep up with digital transformation.

Step 1: Getting an Overview

Regarding innovations in payment transactions, there are many items that require attention. For this reason, it is important to get an initial overview of the current payment transactions situation and a breakdown of the complexity of the factors contained in this term. You should be able to answer questions regarding current payment formats, including abroad, bank communication and possible bank connections before you start making any changes. You should also take into consideration your own payment transactions, in order to recognize weaknesses and potential improvements. Only then will you know if there is still potential for optimization and where the innovation process needs to start.

Step 2: Setting Goals

As is the case with successfully mastering any task, it is important to first set goals in advance and to monitor the results to be achieved. In this way, you prevent inaccurate or unwanted results and a lengthy change process. In order to define your goals, you should compare and consider the potential connections to the bank, systems and formats which are to be used in the future. Moreover, an initial conceptional model of the potential new banking landscape should be developed.

Once the first two steps have been carefully considered, it is down to the nitty gritty: making better decisions.

You can read the full article on the website of Treasury Intelligence Solutions GmbH.

[button url=”https://www.treasuryxl.com/contact/” text=”Contact us” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

Does it make sense to use options for hedging? The following little story is about a senior person who I respect a lot, and who didn’t like using options.

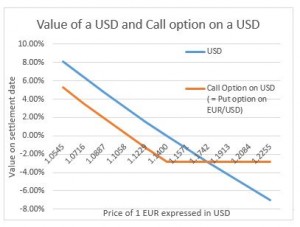

Does it make sense to use options for hedging? The following little story is about a senior person who I respect a lot, and who didn’t like using options.  Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.

Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.