Cloudiness in Libor Transition?

03-08-2021 | treasuryXL | Kyriba | Bob Stark

With less than 6 months to go until the transition from Libor to new overnight risk-free rates, uncertainty lingers as to which rate indices are to be adopted in countries such as the United States.

While regulators remain steadfast in their recommendations that risk free rates such as SOFR in the United States and SONIA in the United Kingdom should be the only choice to replace LIBOR, credit-sensitive rates (CSR) including Bloomberg’s proposed BSBY index remain in the conversation for some market participants and influencers. There are several examples of banks offering new contracts based on the BSBY and other CSRs instead of SONIA, in fact.

Arguments for alternative rates

Arguments for alternative rates

Proponents of credit-sensitive rates such as Bloomberg’s BSBY, AMX’s Ameribor, and HIS Markit’s CRITS suggest that adopting risk free rates such as Sonia does not solve the underlying transparency issues that plagued Libor in the first place. Bloomberg market experts, such as Umesh Gajria, Global Head of Linked Products, have been referenced arguing that robustness of the highly liquid market instruments supporting their calculated index make BSBY, amongst other proposed indices, resilient to manipulation. Regulators in the UK and US do not agree, stating that the market only needs one replacement for Libor and that replacement must be free of risk and market influence.

Time is running out

Whether SOFR prevails or whether a mix of Libor replacement options remain available to corporate CFOs, with less than 6 months remaining until Libor is discontinued, this rate uncertainty is one of the contributing factors explaining why corporates have yet to transition most of their USD contracts away from Libor. While certain Libor USD tenors will continue to be published into 2023, no new contracts in the United States can be based on Libor effective January 1, 2022. Corporate CFOs are running out of time for a solution to move away from Libor.

Treasury systems support all outcomes

Despite the challenges that corporate treasury teams will continue to experience as they sort out which rates should be used in collaboration with their banks and counterparties, FinTech firms including treasury management systems are prepared for any outcome.

Kyriba offers complete Libor transition support within its cloud solution, including backward-looking compounding calculations, amortizations, and online availability for in-advance and in-arrears risk-free and credit-sensitive rates.

If you have questions or concerns, please reach your dedicated Kyriba representative to setup a consultation with our market teams.

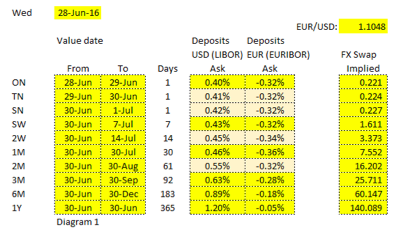

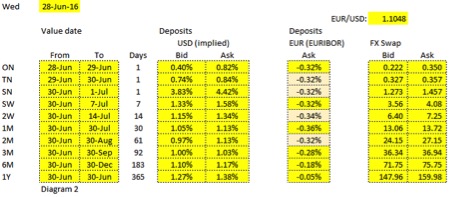

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows:

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows: e are looking at a single day FX swap, the annualized rate could swing a lot.

e are looking at a single day FX swap, the annualized rate could swing a lot.

In the last year both the ECB in regard of EURIBOR and the FCA in London in regard of LIBOR have come to the same conclusion – the fixing of interest rate indices can not carry on in their present form. The current benchmarks are tainted by allegations of fraud and malpractice. Furthermore, the way that the rates are determined are also criticized – no actual transactions take place at the fixing price when the fix is made daily. But the big problem is that these fixings are intrinsically linked to financial contracts with values measured in 100 of trillions of EUR, USD, GBP etc.

In the last year both the ECB in regard of EURIBOR and the FCA in London in regard of LIBOR have come to the same conclusion – the fixing of interest rate indices can not carry on in their present form. The current benchmarks are tainted by allegations of fraud and malpractice. Furthermore, the way that the rates are determined are also criticized – no actual transactions take place at the fixing price when the fix is made daily. But the big problem is that these fixings are intrinsically linked to financial contracts with values measured in 100 of trillions of EUR, USD, GBP etc. Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist