The link between financial performance and working capital metrics

| 10-07-2018 | Theo Paardekooper | treasuryXL

Managing working capital is an important task for treasurers in order to reduce the financial risk of a company and to improve the financial stability. In various studies the costs and benefits of working capital have been claimed.

According to Blinder and Maccini (1991), supply costs and price fluctuations can be reduced by larger inventories and this can prevent loss of business due to scarcity of products. However, there are also effects of investment in working capital, which may lead to a negative impact on firm value. Firstly, keeping stock available imposes costs such as warehouse rent, insurance and security expenses, which tend to rise as the level of inventory increases (Kim & Chung, 1990). Secondly, larger investments in working capital, involves opportunity costs and financing costs (Kieschnick, Laplante, & Moussawi (2013) and this will increase credit risk. Summarizing, working capital management affects the perational performance of the company and external circumstances can influence working capital management accordingly. The corporate treasurer is the key person to create working capital policies and initiate managerial focus on this topic. In order to define the added value of a treasurer in the perspective of working capital management the main question is:

Is there a link between the financial performance of a company and its working capital metrics?

This question can be mathematically rephrased as

![]()

Where the working capital metrics are defined in the Cash Conversion Cycle (CCC)

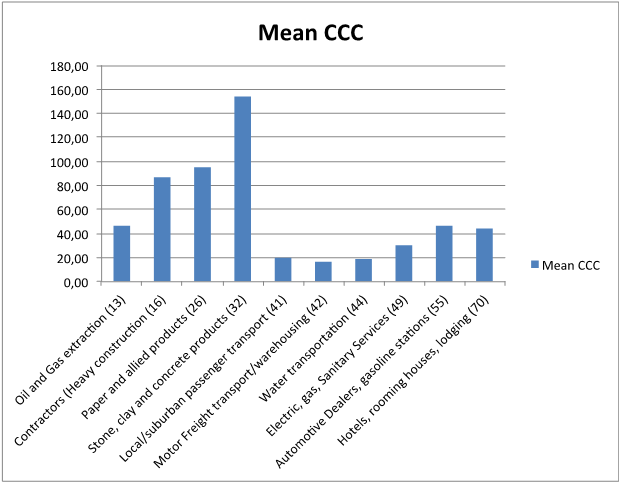

Several studies conclude that a faster rise in the cost of higher investment in working capital relative to the holding of more inventories and or granting trade credit to customers may lead to a decrease in corporate profitability (Deloof 2003) and Shin and Soenen (1998) find in a comprehensive study a strong negative relationship between working capital metrics and corporate profitability for US corporates. Most studies focuses on the linear relationship between financial performance and working capital metrics, however a non-linear relationship between financial performance and working capital metrics is at stake. On top of the non-linear relationship industry specific effects might play an important role. After investigating the statistics of a database containing the financial information of 39.052 non-US listed corporates in a time period between 2010 and 2017 2 samples of scatter charts below give a view on the data

- The results indicate that in 50% of the industries a relationship between financial performance and working capital metrics is confirmed, and this relationship is non- linear. A certain optimum for financial performance is at stake.

- The cash conversion cycle is industry driven as we see a wide range of different cash conversion cycles over various industries.

- Working capital management can improve the financial performance, however based on the data, we see a lot of different results in the working capital metric compared to financial performance. This can indicate there is room for more focus on working capital management

Independent treasury specialist