Factoring – Unlocking the (hidden) potential of your working capital

31-1-2020 | by Ron Wessels

Do you also wait for your customers to pay you after a sale is closed? In today’s world it is getting more difficult to arrange cost efficient traditional bank financing and not everybody has sufficient cash reserves. If funding for you is tight, you can search for alternatives. Many suppliers of alternative funding are quite expensive and their business ethics are not always solid. Perhaps your working capital offers a better solution.

There is a way to convert your outstanding debtors into cash. This is called “Factoring”, offered by factoring companies.

How does Factoring work?

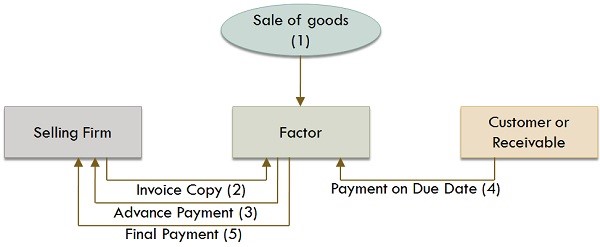

Depending on your existing AR (accounts receivable) portfolio an arrangement with a specialist factor provider can be made to sell those invoices on the date your issue them and get paid within a couple of days (mostly 2-3 days).

You receive most of the cash upfront but yet you are still in charge of the collection process and dunning (there are factoring companies that also offer credit collection services). You want to stay in control of the collection side as this is very important for your Customer Relation, e.g. you want to know if things are not going as they should be. You do not want to outsource the management of potential conflicts with your important clients. Your customers will pay into a bank account in your name but under custody of the factor provider. Obviously, you will have/need full insight on the activities on this bank account. Typically, you get funded about 90% of the face value of the invoice (ex.VAT) and the remainder minus costs, upon collection from the customer. The costs for factoring are depending on the size of your AR portfolio sold but vary around 1,5 to 4%, depending on aforementioned size (this is an estimate and have to be explored during an evaluation). This cost includes the credit insurance.

The factoring program can be tailored either on-balance or off-balance to optimize your accounting processes and your balance sheet strength. Factoring most of the times also requires a credit insurance for the outstanding accounts receivables. Both you as well as the factoring company want to mitigate the risk of clients who cannot pay.

Why is Factoring interesting?

Often factoring, including a credit insurance, is cheaper than traditional bank financing. Especially for companies with no or low credit rating. The factoring industry is more mature than many of the suppliers of alternative funding. This results in more stable processes and improvement of existing processes. Last but not least, the build-up of your balance sheet will be different resulting, amongst others, better financial ratios.

Is factoring difficult to implement?

Not necessarily, you need to agree on the terms and conditions with the factor, the credit insurance and it involves some legal advice/work. Furthermore, you need to agree with the factor on how to deliver the AR data (preferable automated) and the frequency of submission. As this is a mature industry, it is relatively easy to compare quotes of different factoring companies. Two further aspects are very relevant. The first is the quality of your existing processes. If your AR is a bit chaotic, it will be harder to implement the factoring services. Furthermore, the size and activity of your company is important. Small companies with a low number of deals will be treated differently by a factoring company. For example, a mobile telephone operator.

Conclusion

Factoring is a good alternative for traditional bank debt to finance your working capital. It will require up front work but once installed it is easy to maintain at a low cost. A quick scan of your existing AR outstanding can prove whether it is cost efficient to enter such program.

If you are looking for independent advice on factoring before reaching out to suppliers, please contact us. We are happy to help you.

Group Treasurer