Stablecoins: The Silent Revolution Is Already Here

By Nirav Kanakia

The GENIUS Act creates the first U.S. framework for payment stablecoins, with rules on reserves, licensing, and oversight.

Current Status of the GENIUS Act (as of November 12, 2025)

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) is the first real U.S. federal framework for “payment stablecoins.” It focuses on:

- 1:1 reserve backing (USD, Treasuries)

- Monthly disclosure requirements

- AML compliance via Bank Secrecy Act

- Exemptions from securities/commodities laws for compliant issuers

- Dual federal-state oversight

- Both banks and non-banks eligible through licensing

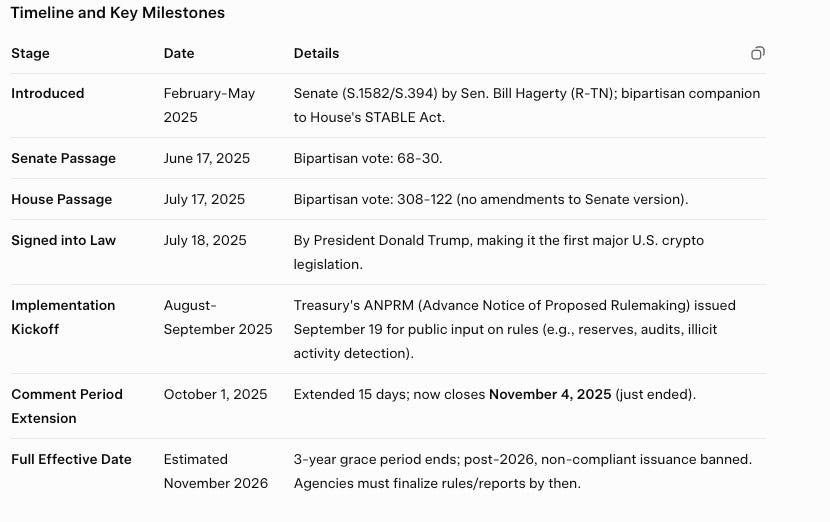

Timeline and Key Milestones

What’s Happening Now (November 2025)

Treasury, OCC, Fed, and FinCEN are reviewing over 1,000 comments from issuers, banks and consumer groups. We expect proposed rules by Q1 2026, focusing on licensing (particularly for $50B+ issuers) and non-payment stablecoins.

During the grace period (until 2026), issuers can operate under existing rules but must prepare for compliance requirements like no interest payments to holders and superpriority redemption in bankruptcy.

Impact

This legislation enables federally authorized issuance (boosting USDC/JPM Coin), aligns with EU MiCA, and supports projected $1.4T+ USD demand by 2027 (JPM estimate).

Critics (including Consumer Reports) point to gaps in consumer protections versus traditional banks.

The U.S. is cementing its leadership in stablecoins ($305B+ market cap), but full implementation depends on the rulemaking process.

For more details: [Congress.gov (S.1582)] (https://www.congress.gov/bill/119th-congress/senate-bill/1582)

Can’t get enough? Check out these latest items

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-12-16 07:00:212025-12-15 12:30:31Stablecoins: The Silent Revolution Is Already Here

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-12-16 07:00:212025-12-15 12:30:31Stablecoins: The Silent Revolution Is Already Here https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-18 07:00:072025-11-28 14:33:19Future of Fintech Report – ai video

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-18 07:00:072025-11-28 14:33:19Future of Fintech Report – ai video https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-05 07:00:482025-11-12 15:38:28Treasury in the Age of Fintech: Insights from Money 20/20

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-05 07:00:482025-11-12 15:38:28Treasury in the Age of Fintech: Insights from Money 20/20 https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-30 08:41:272025-07-30 08:41:27GENIUS Act Signed – Stablecoins Get Clarity! (pun intended)

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-30 08:41:272025-07-30 08:41:27GENIUS Act Signed – Stablecoins Get Clarity! (pun intended) https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-23 07:00:062025-07-22 10:00:54AI vs. Stablecoins: Treasurers’ Surprising (is it) Verdict

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-07-23 07:00:062025-07-22 10:00:54AI vs. Stablecoins: Treasurers’ Surprising (is it) Verdict https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-24 07:00:242025-06-23 10:59:38In House Bank – Your Money Works For You Under Your Watch

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-24 07:00:242025-06-23 10:59:38In House Bank – Your Money Works For You Under Your Watch https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-10 07:00:552025-06-10 09:06:37Banking Without Bankers: The AI Bank – 2030

https://treasuryxl.com/wp-content/uploads/2025/06/Nirav-Interview-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-10 07:00:552025-06-10 09:06:37Banking Without Bankers: The AI Bank – 2030 https://treasuryxl.com/wp-content/uploads/2025/05/Nirav-Interview.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-06 07:00:342025-05-22 13:05:58Interview | Still Coding, Still Curious: Nirav’s Journey into Fintech and Treasury Tech

https://treasuryxl.com/wp-content/uploads/2025/05/Nirav-Interview.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-06 07:00:342025-05-22 13:05:58Interview | Still Coding, Still Curious: Nirav’s Journey into Fintech and Treasury TechOther sources

- https://www.congress.gov/119/bills/s1582/BILLS-119s1582enr.pdf

- https://www.congress.gov/crs-product/IN12553