Strategic Treasurer’s Technology Use Survey, now in its 5th year, has gathered data and feedback from over 1,000 treasury and finance practitioners since 2017. This annual survey explores the usage and satisfaction levels of various treasury technologies and highlights industry trends.

The 2023 survey reveals several key trends:

- SaaS and cloud technology continue to dominate as preferred choices for treasurers adopting new software solutions, with an 11% increase since 2021.

- Corporate interest in AI and ML solutions for cash forecasting and fraud prevention is at an all-time high, with 23% of respondents indicating their fintech partners offer AI and ML solutions.

- API adoption for payments and reporting functions is growing rapidly, with 45% of treasury teams using APIs for information reporting and 28% for executing payments.

- FedNow, the Federal Reserve’s instant payment service, is gaining traction, with 15% of U.S. treasury teams actively using it and another 15% planning to integrate it within the next 12-24 months.

- Despite technology advancements, TMS implementations often take longer than expected, with 57% of practitioners expecting quick implementations but only 38% achieving them.

Furthermore, the research shows that ~20-30% of the capabilities implemented by treasury teams are going unused due to various reasons, highlighting the need for better evaluation and training. Lastly, AI and ML capabilities are gaining importance in technology evaluations.

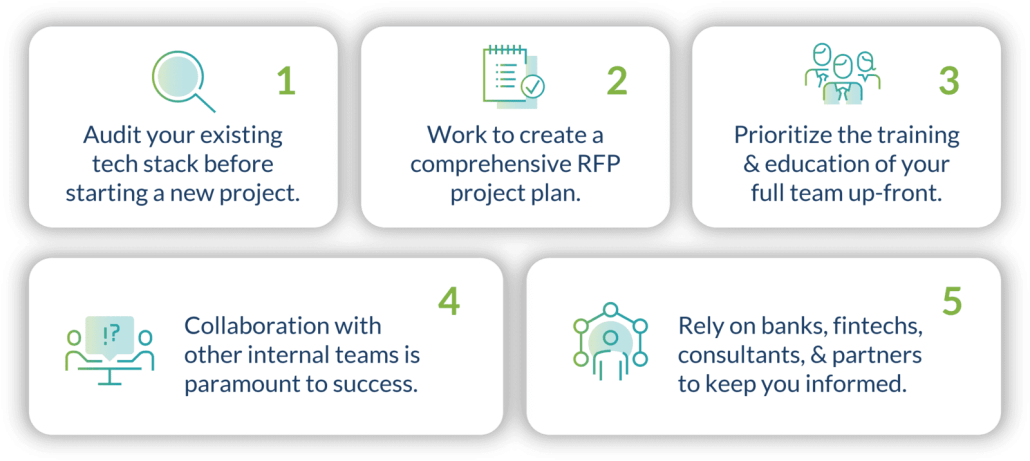

To optimize treasury technology strategies in 2023-2024, practitioners are advised to:

- Perform a comprehensive audit of existing technology.

- Develop a thorough RFP process and conduct due diligence on vendors.

- Prioritize education and training for employees during implementations.

- Collaborate with internal departments and external partners.

- Stay informed about industry developments through banks, consultants, and industry associations.

For more detailed information and insights, read the full report on this link.