I will look at different types of interest for commercial banks, and how that is linked to interest applied by an In-House Bank.

In general, commercial banks calculate current account interest on the basis of risk and balance commitment. This means that a commercial bank will apply different interest rates; for credit interest the commercial bank will look at the time that idle cash will sit in the bank account and what is the risk (or freedom) of the accountholder to withdraw the balance. For debit interest, the commercial bank will assess the time and amount that an overdrawn balance will exist as well as the risk that the account owner will (or can) get the overdrawn bank account back to a positive balance.

However, when both credit balances and debit balances will exist for a longer time, commercial banks will offer different solutions with more favorable interest rates. But the favorable rates will usually come with restrictions.

In the case of a credit balance, banks may offer better interest rates if the account holder maintains a certain positive balance in the account for a certain period. Banks can also request account holders to transfer the positive balance to a separate account from the bank in order to apply a more favorable interest rate. In financial terms we call this “time deposits”.

The interest rate of a time deposit will depend on the amount, tenor and the revocability of the transferred balance. The higher the amount, the longer the tenor, the lower the revocability, the higher the credit interest.

Conversely, for a debit balance the banks may offer better interest rates when the account holder agrees on an amount that is needed to cover for the overdrawn balance. These agreements usually include conditions that stipulate how long the amount is needed, when will the amount is needed to be paid back and whether the amount can be reused again after paying back. In financial terms we call this “loans”.

Obviously, banks can offer a range of similar interest-bearing products that can be tailored to the specific needs of a customer or of the bank. All is based on the core banking model as explained in the first chapter of the white paper. The bank business model is based on the difference between debit and credit interest. Time and risk, but also the level of balance will determine what interest rate a bank is willing to offer to account holders.

Also, the balance sheet of a bank may set guidelines for the interest rate settings. A bank with too much risk on the balance sheet (or a certain mismatch between the assets and liabilities) may cause a bank to decide to offer higher credit interest rates than competitors. This is to attract additional cash. To further reduce the balance sheet risk, a bank can also increase debit interest to discourage accountholders to overdraw their accounts or to reduce (outstanding) loans.

Vice versa, banks that are “overfunded” (meaning they have too much cash / liabilities on the balance sheet) may consider lowering the credit interest to discourage customers cash balances and lowering debit interest to encourage customers to take more loans.

Calculation of Current Account Interest

Commercial banks view current account balances as uncommitted cash and as such cash that can be withdrawn instantly by the account holder (high risk). To support that, commercial banks use a reference rate (usually based on overnight rates) and apply a relatively large discount spread on credit balances and a relatively large uplift spread on debit balances to calculate the applied interest on daily current balances. With this approach, commercial banks incentivize account holders to convert non

current larger balances to more committed cash balance (= time deposits). This means that banks will apply a relatively small discount spread on committed cash deposits. In the previous chapter I was referring to “time deposits”; the longer the tenor of committed cash deposits (1 month, 3 months, 6 months, 12 months), the smaller the discount spread on cash deposits (and thus a higher interest yield).

Vice versa, banks apply a relatively small uplift spread on committed loans; various committed loan types with various tenors will get different smaller uplift spreads.

In general, the following sample schedule shows the relationship between applied interests on various types of cash flows:

| Reference rate | Inter Bank Offered Interest Rate – Overnight |

| Lending/borrowing | Applied spread (indicative sample) |

| current account credit balance | -/-200 Basis point |

| current account debit balance | +/+ 500 Basis point |

| cash deposit | -/-100 Basis point |

| loan | +/+ 300 Basis point |

With this sample schedule the commercial bank says: I offer you a better interest rate (-/- 100 Bps Spread) when you make a cash deposit with me for a certain committed time. However, if you leave your balance sitting in your current account, I offer you a less interesting rate (-/- 200 Bps Spread).

Vice versa, in this sample schedule the bank says: If you take out a loan with me, I offer you a better interest rate (+/+ 300 Bps Spread), then when you leave your current account overdrawn (+/+ 500 Bps Spread).

The reason for this is the controlled and calculated risk that goes with time deposits and loans, versus uncontrolled current account balances.

To make the previous schedule a bit more visual, in the schedule below I have applied an Inter Bank Offered interest Rate – Overnight (IBOR) of 5% (500 Bps).

Sample numbers of interest rates

| Reference rate | 5% |

| Lending/borrowing | Applied spread (indicative sample) |

| current account credit balance | (5% – 200 bps) = 3% paid by the bank |

| current account debit balance | (5% + 500 bps) = 10% received by the bank |

| cash deposit | (5% – 100 bps) = 4% paid by the bank |

| loan | (5% + 300 bps) = 8% received by the bank |

In this example the reference rate is based on the daily Inter Bank Offered Interest Rate – Overnight , which is the daily rate for banks when lending money to another bank overnight. So, a bank has a choice to manage interest revenues by means of the counterparty being another bank. Or increase the revenue by having customers being the counterparty.

As banks use the relationship between applied spreads to generate revenue (the difference between debit interest received and credit interest paid is revenue for a bank), a bank effectively is managing its balance sheet. Obviously, this applies to both short term money (current account) and long-term money (time deposits and loans). But the essence is that, while a bank is managing its balance sheet, long term interest for both debit and credit are closer to the reference rate, and short-term interest rates both debit and credit are further away from the reference rate.

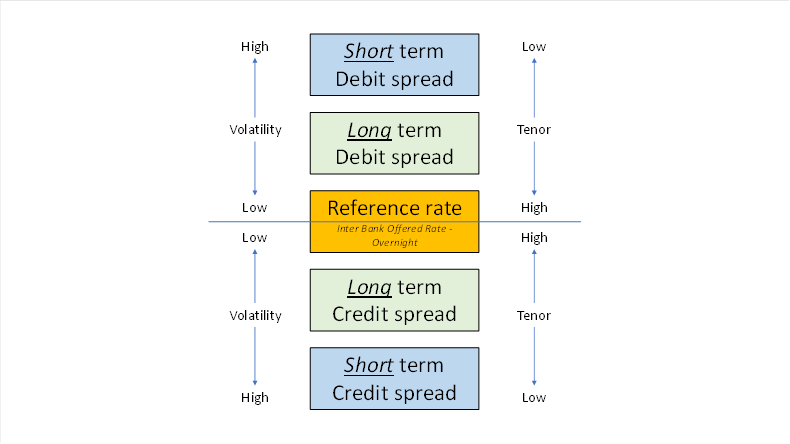

With this ration a bank is encouraging account holders to convert as much as possible current account money to more long-term money (“time deposits” for credit and “loans” for debit). Hence for applied spreads we can draw a general relationship between long term spread and short term spread. See picture below. The higher the volatility and the lower the tenor (both typical for current account as this is daily cash in and cash out), the higher the spread.

General relationship between long term spread and short term spread

Interest spreads for the In-House Bank

The In-House Bank (IHB) is strictly for the purpose of efficiently managing working capital cash of the company. Therefore, there is no justification to apply commercial spreads on applied interest; the IHB does not have a primary focus on generating revenue. In fact, many international companies that have a similar cash management structure traditionally have kept the credit interest spread at a fixed -/-50 bps and debit interest spread at fixed +50 bps relative to an annually fixed reference rate (traditionally LIBOR USD, EUR or GBP). Some companies even have fixed the interest rate (not the spread) to read credit interest 0.5% and for debit interest 0,75%. But having a fixed interest rate of 0.5% for both debit and credit is also not uncommon.

The rationale behind these fixed IHB interest rates used to be: (a) it’s all intercompany, (b) it is a lot of work to tailor interest rates per currency per legal entity and maintain it.

However, there is a tendency with tax authorities across the globe to scrutinizing more and more In House Banks solutions and applied interestspreads. Domestic Tax authorities scrutinize individual legal entities and tend to not look at international group level. As such they have been arguing that any normal managed legal entity with significant cash excess doesn’t leave significant cash excess in the current account and would have got different (read: higher) interest rates when investing cash by means of depositing at external banks or investment funds. Vice versa, a normal managed legal entity does not keep its current account long term overdrawn; it would have negotiated lending facilities with better (read: lower) interest rate conditions.

In another white paper “Tax considerations in light of Transfer Pricing when setting up Zero Balance Cash Pool arrangements” previously published by me, reference is being made to a number of civil court cases between local Tax Authorities and companies that have established Zero Balancing Cash Pool structures. The overarching conclusion from several court cases is:

- Companies will need a Cash Management Agreement with every individual legal entity. Agreement will need to be legally and duly signed.

- This Cash Management Agreement will need to outline the services of the In-House Bank (or central treasury). For more information, see white paper “Legal aspects In-House Banking“ https://solusius.com/wp-content/uploads/2024/03/Legal-aspects-IHB-6-3-24.pdf

- In case of a ZBA structure, a clear policy or guideline needs to be included to specify daily interest renumeration applied for InHouse balances in the cash pool. It also needs to specify different interest spreads applied for debit interest and credit interest.

- Interest spreads on current account InHouse balances need to be clearly different from interest spreads on intercompany lending and depositing.

- To support interest rate settings the Cash Management Agreement needs to clearly define the applied reference interest rate.

- Interest rates need to be set in such a way that operating units are challenged when leaving substantial balances(both debit and credit) unmanaged in the In-House Bank Current Account. In other words, an operating entity needs to be encouraged to either invest substantial cash balances through the central treasury (the In-House Bank) or use intercompany lending to finance the operations.

- The In-House Bank will need to differentiate the interest spread based on the balance sheet assessment of every operating unit participating in the ZBA Cash Pool structure. (see additional comments OECD BEPS and Transfer Pricing – Differentiate interest depending on balance sheet).

To prevent any detailed discussions with local Tax Authorities, I strongly suggest to draft such a Cash Management Agreement (see white paper “Legal aspects In-House Banking“) and ensure the included interest rate policies are embedded in the ZBA Cash Pool structure.

Key of the interest rate policies is to apply interest spreads that have a similar ratio as commercial banks apply. The ratio between applied interest on current account balances (working capital) versus applied interest on term lending & depositing (the latter is usually referred to as InterCompany lending). But a key difference with commercial banks is that the ratio for In-House Bank balances can be much narrower than commercial spreads (see Transfer Pricing).

The last bullet (“The In-House Bank will need to differentiate the interest spread based on the balance sheet assessment of every operating unit participating in the ZBA Cash Pool structure”) can be a labor intensive activity for a company. If it can be justified to Tax Authorities that such a interest spread differentiation is omitted because of efficiency reasons, changes are that this is accepted by Tax Authorities.

Key in this is that there is a clear Cash Management Agreement that shows clear Tax & Treasury policies aligned with Arm’s Length principles. Not having outlined clear Tax & Treasury policies in a Cash Management Agreement will trigger Tax Authorities to challenge the ZBA Cash Pools structure. see white paper “Legal aspects In-House Banking“.

Proposed interest spreads for the In-House Bank

The first step is to select a reference rate. This is important as this will be the central interest rate that In-House Bank balances and intercompany lendings (and depositings) will be using to determine the applicable interest rate.

Companies that are leveraged usually use the external cost of borrowing as the reference rate. Companies that do not have any (significant) external borrowing I suggest to use the official overnight lending rate per currency as published by the local central bank of the respective currencies as the In House Bank reference rate.

Samples of overnight published rates (+ actual rate mid-2023) are:

| Currency | Name overnight (interbank) rate | Abbreviation | Actual rate |

| USD | Secured Overnight Financing Rate | SOFR | 5.30% |

| EUR | Euro Short-Term Rate | ESTR | 3.652% |

| JPY | Tokyo Overnight Average Rate | TONA | -/-0.07% |

| GBP | Sterling Overnight Index Average | SONIA | 5.1823% |

| PLN | Poland Warsaw Interbank Offered Rate | WIBOR | |

| in 2023 replaced by Warsaw Index for Financial Market | WIRF | 6.75% | |

| CHF | Swiss Average Rate OverNight | SARON | 1.704863% |

See also https://www.global-rates.com/en/

For any In-House Bank interest spread a good suggest per currency is:

| Reference rate | Overnight (interbank) rate |

| Lending/borrowing | Applied spread |

| current account credit balance | -/-200 Basis points |

| current account debit balance | +/+ 400 Basis point |

| cash deposit | -/-100 Basis point |

| loan | +/+ 150 Basis point |

USD Samples of applied IHB interest:

| Reference rate | 5.30% |

| Lending/borrowing | Applied spread |

| current account credit balance | 3.30% |

| current account debit balance | 9.30% |

| cash deposit | 4.30% |

| loan | 6.80% |

EUR Samples of applied IHB interest:

| Reference rate | 3.652% |

| Lending/borrowing | Applied spread |

| current account credit balance | 1.652% |

| current account debit balance | 7.652% |

| cash deposit | 2.652% |

| loan | 5.152% |

Managing multiple operating accounts in multiple currencies will make daily IHB interest related activities fairly labor intensive. To handle this, a Treasury Management System will replace these daily manual activities with automated processes. Many Treasury Management Systems will be able to lodge any sweep to&from IHB accounts. At business close each IHB account will have a closing balance. A Treasury Management System will be able to accommodate for any desired interest schedule as suggested above and apply the interest schedule to all IHB accounts at close of business. With automated links to market data, Treasury Management Systems will be able to utilize daily updated overnight (interbank) rates when those market rates are being used as the Reference Rate.

By doing so a Treasury Management System will support the In-House Bank when managing the interest application.

Transfer Pricing – Tax & Accounting treatment of IHB balances

As indicated before, the mechanism of IHB accounts mimics the mechanism of external commercial bank accounts. Hence the mirroring of the relationship between applied interests (debit & credit, and working capital versus long term). However, in general the vast majority of In-House Bank structures do not have a formal “banking license”, nor are In-House Bank structures generally set up as a true profit center. With this in mind, domestic Tax Authorities consider In-House Bank structures as InterCompany lending solutions; they generally do not see the IHB accounts as “bank accounts”. Various representative legal cases evidence this (see my white paper “Tax considerations in light of Transfer Pricing when setting up Zero Balance Cash Pool arrangements”, from 2021 January), where Tax authorities argued in court that incorrect interest was applied to In-House Bank accounts when companies kept the In-House Bank interest rates a fixed low rate linked to a fixed reference rate (see also “Proposed interest spreads for the Moderna In-House Bank”).

Both from Tax as well as Accounting perspective, the assets & liabilities of the In-House Bank represented by the daily In-House Bank accounts balances will need to be treated as daily short-term InterCompany loans.

In the event that a legal entity receives a long-term InterCompany loan as long-term financing, it will need to be treated by Tax as well as Accounting as a true long-term loan. Meaning that an InterCompany Loan needs to be treaded similar to an external commercial bank loan. Similar to a loan from an external commercial bank, the cash associated from an InterCompany loan can be deposited by the In-House Bank either on the external bank account or on the In-House Bank account.

This applies also to excess cash on an In-House Bank account. Similar to a cash deposit/investment with an external commercial bank, an operating unit can deposit/invest InterCompany excess cash with the In-House Bank for a certain period and receive deposit interest.

Assuch, a cash deposit/investment can be seen as an InterCompany loan, but from the operating entity to the In-House Bank.

In banking, loans and deposits/investments are always seen from the point of view from the bank. Therefore, any InterCompany loan will require a different (debit) interest spread then any InterCompany cash deposit/investment (credit interest spread) as suggested in the table of “Suggested In-House Bank Interest Spreads”. For this matter a long-term depositing of excess cash at the In-House Bank is Accounting wise the equivalent of an InterCompany loan, but in reversed order (from the legal entity to the In-House Bank).

OECD BEPS and Transfer Pricing – Differentiate interest depending on balance sheet As referenced before (see third section from Interest spreads for the In-House Bank), tax authorities are more and more scrutinizing In-House Banks solutions and applied interest spreads. To support this, a number of countries that are working together to streamline economic market forces through the OECD organization, have defined guidelines to prevent tax Base Erosion and Profit Shiftings that may occur from non-realistic spreads applied in In-House Bank structures. The guidelines are known as OECD BEPS.

In short, the OECD BEPS guidelines stipulate that In-House Banks need to have a solid and realistic substantiation of applied spreads. In addition, a solid and realistic substantiation of applied spread potentially could mean that spreads must differ per legal entity, similar to how external commercial banks assess terms & conditions for customer legal entities individually (see white paper “OECD BEPS and Transfer Pricing – Differentiating In-House Bank interest depending on balance sheet” January 2024).

Furthermore, the OECD BEPS guidelines require proper documentation for applied spreads on In House Bank balances and InterCompany lending (see white paper “Legal aspects In-House Banking“).

Documentation

To support the OECD BEPS guidelines, companies will be required to set up Cash Management Agreements:

- Documenting the rationale behind applied spreads as mentioned in Proposed interest spreads for the In-House Bank.

- Documenting the terms and conditions (and applied spreads) for current account balances linked to the sweeps from Zero-Balance cash pools (usually documented by means of a Cash Management Agreement with legal entities).

- Documenting the terms and conditions (and applied spreads) for any intercompany lending (both from the In-House bank to a legal entity – aka IC loan – and vice versa – aka cash deposit).

Proper documentation will satisfy Transfer Pricing principles(see white paper “Legal aspects In-House Banking“).

Netting

As a note to the mechanisms of In-House Banking, intercompany invoices can be settled on In-House Bank accounts similar to settling vendor invoices through the external bank accounts. There is no need for accumulating intercompany invoices to settle the net position periodically. By settling IC invoices through the In-House Banking accounts, the net position from the In-House Bank does not change; only the individual Assets & Liabilities (In-House Banking accounts) with respective legal entities will change. This will need to documented in the Cash Management Agreement.

By Paul Buck

List of referenced documents

- White paper “Guidelines for Transfer Pricing Related Interest & Spreads applied in Zero Balancing Cash Pools – Part 1”, 2024 February, Paul Buck

- White paper “Legal aspects In-House Banking“, 2024 March, Maarten Steyerberg, Solusius https://solusius.com/wp-content/uploads/2024/03/Legal-aspects-IHB-6-3-24.pdf, • White paper “Tax considerations in light of Transfer Pricing when setting up Zero Balance Cash Pool arrangements”, 2021 January, Paul Buck

• White paper “OECD BEPS and Transfer Pricing – Differentiating In-House Bank interest depending on balance sheet”, 2024 February, Paul Buck