Re-inventing treasury workflows: Smart Treasury

| 3-8-2017 | Nicolas Christiaen | Cashforce | Sponsored Content |

While the role of the treasurer is changing, it becomes increasingly challenging to maintain the current workflows and simultaneously take on new demanding tasks. One of these often manual and time-consuming tasks is risk management. As seen in, among others, this year’s Global Treasury Benchmark Survey of PwC, the registration and management of financial instruments stands among the top 3 challenges on the agenda of the surveyed treasurers. In this article, we take a more in-depth look at possible optimizations in some key treasury workflows.

While the role of the treasurer is changing, it becomes increasingly challenging to maintain the current workflows and simultaneously take on new demanding tasks. One of these often manual and time-consuming tasks is risk management. As seen in, among others, this year’s Global Treasury Benchmark Survey of PwC, the registration and management of financial instruments stands among the top 3 challenges on the agenda of the surveyed treasurers. In this article, we take a more in-depth look at possible optimizations in some key treasury workflows.

Example FX management workflow

Hedging your FX exposure risk made easy

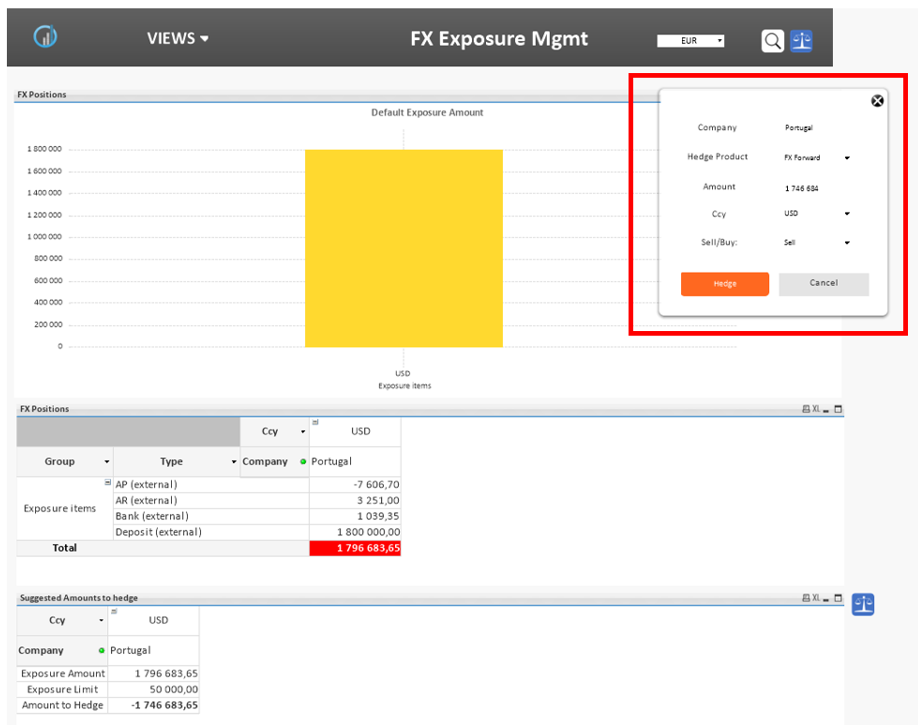

A common problem is the lack of visibility on the existing (global/local) FX exposure risk.

In order to calculate the FX transaction risk, transactional data from the TMS & ERP systems need to be consolidated effectively. Typically, this happens to be a (very) painful exercise. With Cashforce, however, using our off-the-shelf connectors (for ERP & TMS) and our full drill-down capabilities, you have all FX exposures at your fingertips.

FX Exposure Management – Current positions & exposures

But there is more to it. Imagine that linked to your FX exposure, an automated proposal of the most relevant FX deal would be generated to properly hedge this risk. A grin from ear to ear you say?

FX Exposure Management – Suggested hedge

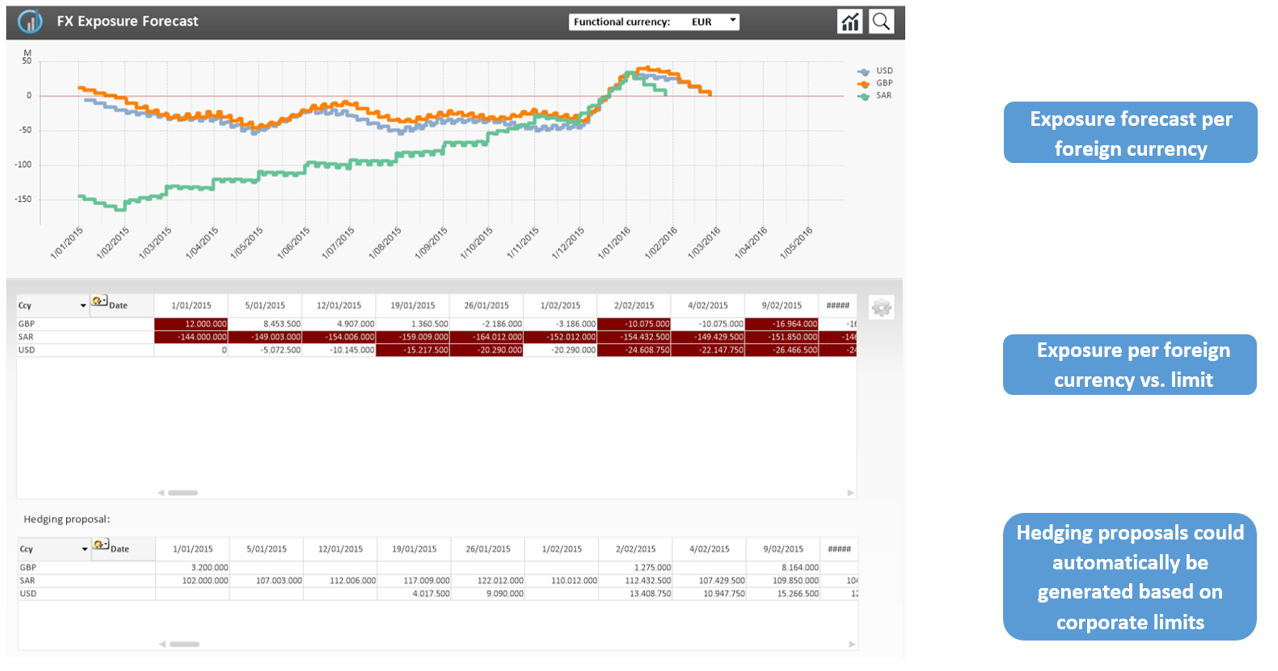

And what about forecasting FX exposures? It’s now all within reach!

FX Exposure Management – Future positions & exposures

FX Exposure Management – Future positions & exposures

Whether you choose to take on an intercompany loan, a plain vanilla FX forward or another more exotic derivative product, chosen deals could then be automatically passed on to your deal transaction platform, to effectively execute the deal without any hassle. After execution, deals will automatically flow back into the system. Consequently, a useful summary/overview will be generated to effectively manage all your financial instruments.

Workflow integrated cash forecast

Finally, integrated cash management

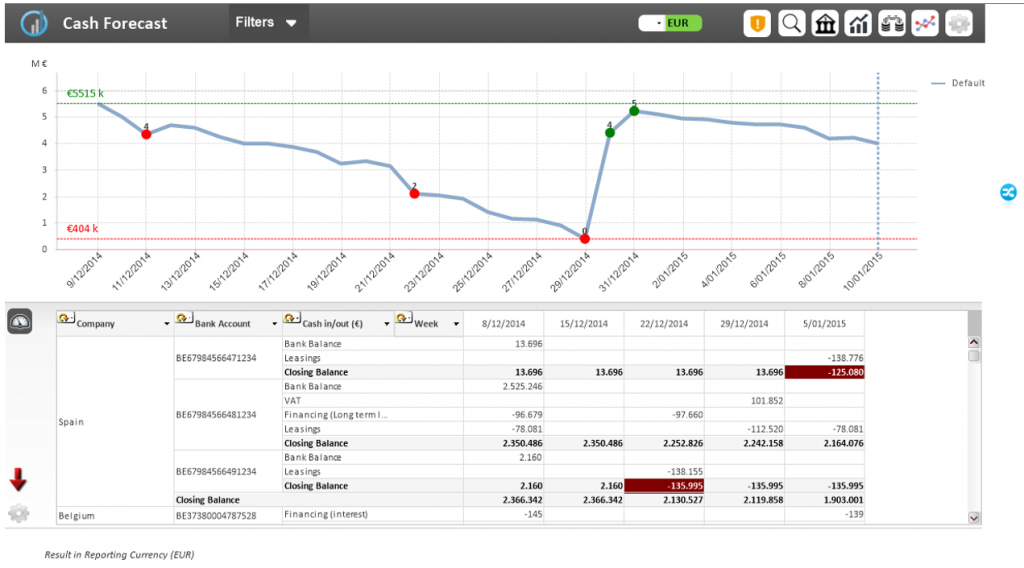

New financial instruments / deals will generate a set of related cash flows. Ideally, these are directly integrated in your cash flow forecasts. In Cashforce, this data is automatically integrated within the cash flow forecast module, and will be put into a dedicated cash flow category. Learn more one how to set up an effective cash forecast in this article or this webinar.

Cash flow forecast overview

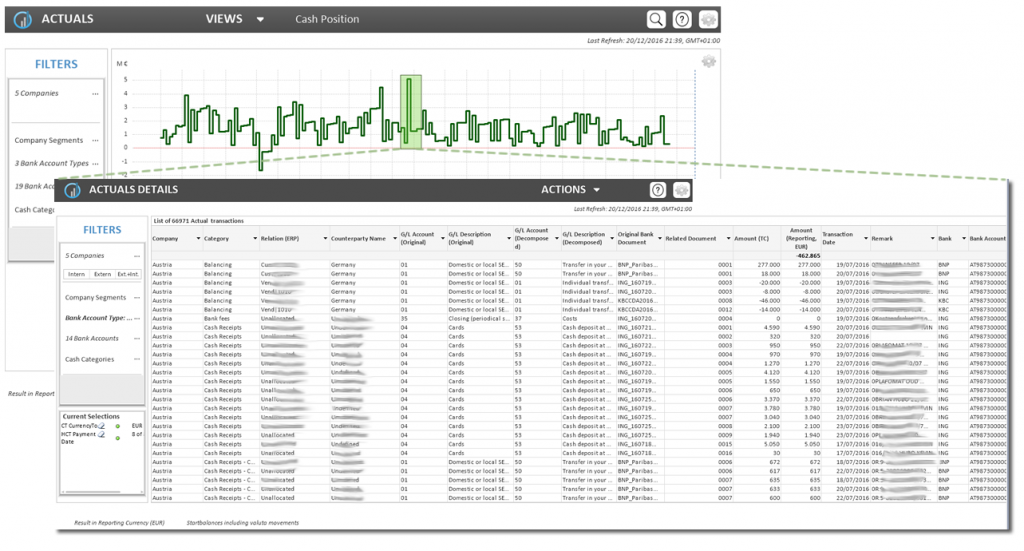

The analysis possibilities are now limitless, thanks to the ability to drill down to the very transactional-level details. The real number crunchers strike gold here: the analysis features open doors to unlimited in-depth analysis and comparison of various scenarios (E.g. the simulated effects of various exchange rate movements).

Drill-down to the transaction level

Using our big data engine, the delivery of rich and highly flexible reporting is facilitated. It’s fair to say that the typical SQL server (which currently 95% of the TMS systems use) can’t hold a candle to this. Through an advanced ‘self-service’ interface, users can drill down completely into respective amortization tables, historical transactions and effortlessly create customized reports and dashboards. We’ll talk more about why we believe Big Data engines are crucial for any Treasury software in our next blog.

Integration with ERPs & payment platforms

Next to this, Cashforce will automatically generate the accounting entries (in the format of your ERP/accounting system) related to your deals. The appropriate payment files will be generated in a similar fashion.

So…

As might be clear after reading this article, we strongly believe that integrated data flows & a Big Data engine are the foundation of a new type of Treasury Management System that runs like clockwork and can serve effective treasury departments, but also renewed finance/controlling/FP&A departments.

You are curious to hear more about effective treasury management? We’ve recently recorded a webchat on how to set up an efficient cash flow forecast process.

Managing Partner at Cashforce