In the ever-evolving world of financial transactions, the adoption of instant bank payments has become a catalyst for transformational change in both the corporate and consumer sectors. Today, this transition from traditional payment methods to real-time, 24/7 transactions is reshaping how businesses and individuals navigate the financial landscape on a global scale.

This article will explore the evolution of instant payments within the corporate sector, and more specifically, how their adoption is impacting the world of treasury and finance. We will begin with exploring the primary benefits associated with their usage before delving into the main use cases that exist in 2024. Next, we will evaluate current challenges that are obstructing the adoption of real-time payments and explore several of the leading institutions and payment systems tasked with real-time deployment across the world. Finally, we will demonstrate how the TIS cloud platform enables corporate treasury and finance teams to adopt real-time payments gradually without abandoning their traditional payments and reporting channels.

Instant Payments Revolution: The Benefits

Instant payment schemes have been making waves worldwide, offering unparalleled advantages for businesses and individuals alike. When we examine the underlying benefits in the corporate realm, there are several key factors driving their adoption:

Speed & Accessibility: The main characteristic of instant payments is their speed. Regardless of the geographical location or the time zone, users can execute transactions swiftly, eliminating the delays and processing uncertainty associated with traditional banking hours. This immediate access to funds offers unprecedented financial flexibility. A service that is available 24 hours a day, 7 days a week.

Transparency & Control: Because transactions are usually completed in instantly with very little time between a payment being sent and delivered, both the payor and payee have greater insight to the status of payments compared to methods where it might take a full day, or even multiple days, for funds to be delivered. This has historically been a major issue with the correspondent banking model, with various legacy cross-border payment systems, and even with various domestic payment options, such as checks (cheques) in the USA.

Streamlined Operations: The streamlined nature of instant payments simplifies financial operations for both businesses and individuals. Whether it’s receiving salaries, making bill payments, or managing day-to-day transactions, the efficiency of instant payments improves the overall financial management for companies or consumers that leverage them.

Cash Flow Management: For enterprise organisations, managing cash flows is crucial. Services like FedNow in the USA, Faster Payments in the UK, and SEPA Instant Credit Transfers (SCT Inst) in Europe all empower large corporates with the ability to transfer funds instantly between accounts. This not only enhances cash flow management but also contributes to overall financial resilience and strategic planning.

Use Cases Accelerating the Adoption of Instant Payments

In the dynamic landscape of instant payments, various use cases are reshaping how businesses and individuals engage and interact in financial transactions. The swiftness and accessibility of instant payments are paving the way for various applications, enhancing efficiency and responsiveness across different domains. Here are some concrete examples:

Business-to-Person (B2P) Use Cases:

- Urgent pay-out of compensation such as government welfare or insurance claims to consumers.

- Instant payments for services delivered by freelancers, self-employed individuals, or dayworkers at the completion of a project.

- Payroll and compensation that businesses must pay to their employees on a given date.

- Immediate reimbursement by merchants for returned goods purchased by consumers.

- Expedited correction of payment errors or oversights.

Business-to-Business (B2B) Use Cases:

- High-value intercompany transfers driven by short-term treasury needs.

- Faster reconciliation and instant feedback.

- Payment of insurance premiums for immediate coverage.

- Settlement of taxes, fines, or penalties on an urgent basis.

- Facilitating money transfers between businesses, replacing traditional bank-confirmed cheques.

- Overcoming limitations on cash or card transactions for high-value purchases, both at national, EU level, as well as globally.

- Cash management solutions powered by simplified forecasting and improved strategic planning.

- Timely invoice and bill payments to avoid late penalties or service cut-offs.

- Expedited purchase or payments for high-value items like expensive cars, requiring immediate fund confirmation.

In general, we can conclude that the adoption of instant payments is revolutionizing financial interactions, offering 24/7 unprecedented speed and efficiency, across diverse scenarios. Whether settling urgent compensation, streamlining business transactions, or facilitating seamless online purchases, instant payments are at the forefront of transforming the way we transact in the modern world.

A Global Perspective: Instant Payment Schemes Worldwide

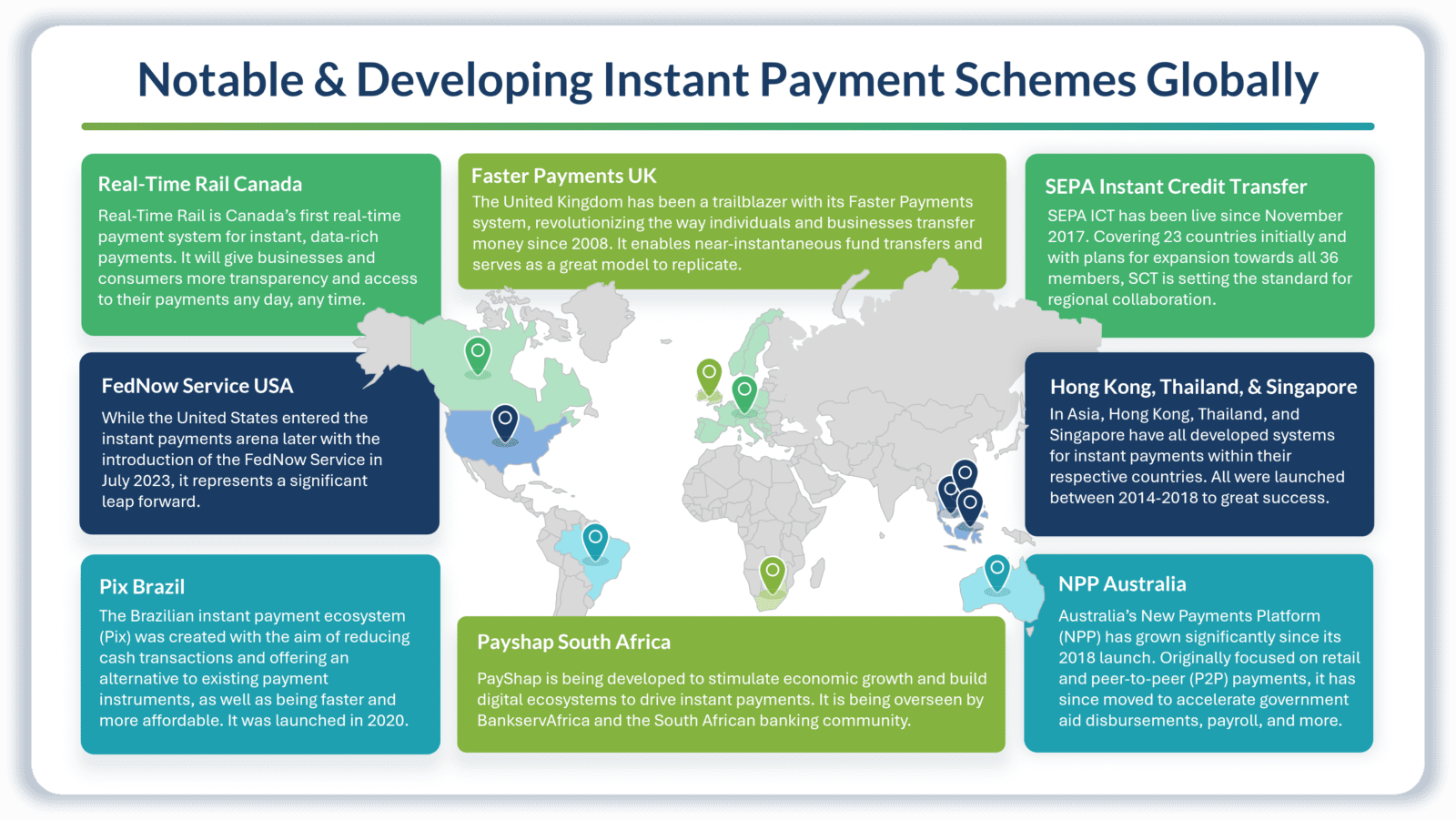

As the benefits of instant payments and strategies regarding how best to implement them gain momentum, many countries have embraced real-time transaction systems, contributing to the global shift towards faster, more efficient financial transactions. Beyond the SEPA Instant Credit Transfer (SCT Inst) scheme in Europe, notable instant payment schemes have emerged worldwide. Here are just a few examples successfully incorporated by TIS:

FedNow Service in the United States: While the United States entered the instant payments arena later with the introduction of the FedNow Service in July 2023, it represents a significant leap forward. The service, developed by the Federal Reserve, empowers financial institutions across the U.S. to provide real-time payment services, aligning with the global move towards instant transactions.

Faster Payments in the UK: The United Kingdom has been a trailblazer with its Faster Payments system, revolutionizing the way individuals and businesses transfer money. Introduced in 2008, Faster Payments enables near-instantaneous fund transfers, providing a model for other nations exploring real-time payment solutions.

SEPA Instant Credit Transfer Scheme in Europe: The SEPA Instant Credit Transfer scheme, operational since November 2017, has significantly influenced the European payments landscape. Covering 23 countries initially, with plans for expansion towards all 36 members, “SCT Inst” allows instantaneous cross-border transactions within the Eurozone, setting a precedent for regional collaboration.

Faster Payment System (FPS) in Hong Kong: Hong Kong’s Faster Payment System (FPS) is another noteworthy initiative, introduced in 2018. FPS facilitates swift, round-the-clock fund transfers, enhancing financial accessibility and promoting a cashless society. The system has garnered widespread adoption, reflecting the global trend towards real-time payments.

FAST Payments in Singapore: Singapore’s FAST (Fast and Secure Transfers) payment system has positioned the country at the forefront of the global instant payments movement. Launched in 2014, FAST enables individuals and businesses to transfer funds seamlessly, reinforcing Singapore’s reputation as a financial hub with cutting-edge payment solutions.

PromptPay Thailand: PromptPay was launched in 2016 as a payment system enables customers in Thailand to send or receive Thai Baht funds via digital channels in real time.

New Payments Platform (NPP) Australia: The NPP (New Payment Platform) is a new platform launched in 2018 that gives Australian consumers and institutions a new way to make everyday payments. Today, the NPP allows Australians to make low-value payments 24 hours a day in less than 30 seconds. The system operates seven days a week, 365 days a year, with no holiday breaks.

The below graphic also offers more insight to various instant and real-time payment schemes in development globally.

NOTE: This is not a complete list. Many other instant payment schemes are in development or have been recently deployed (including throughout the Middle East, Africa, and South America).

Challenges in the Instant Payment Landscape

While it may sound simpler in theory, discussing instant payments today reveals a complexity that extends beyond a single definition. When we talk about instant payments, there are different perspectives on what it means. Some link them to Open Banking, others to Instant SEPA Credit Transfers, FedNow, Credit Card payments, SWIFT GPI Cross-Border Payments, and various other forms. There are even those who consider instant payments as synonymous only with API payments. Each one of these viewpoints are valid. Yet, this diversity just highlights the complex nature of the payment landscape. With the introduction of the instant payments the landscape becomes even more complicated and diverse, contrary to simplifying matters.

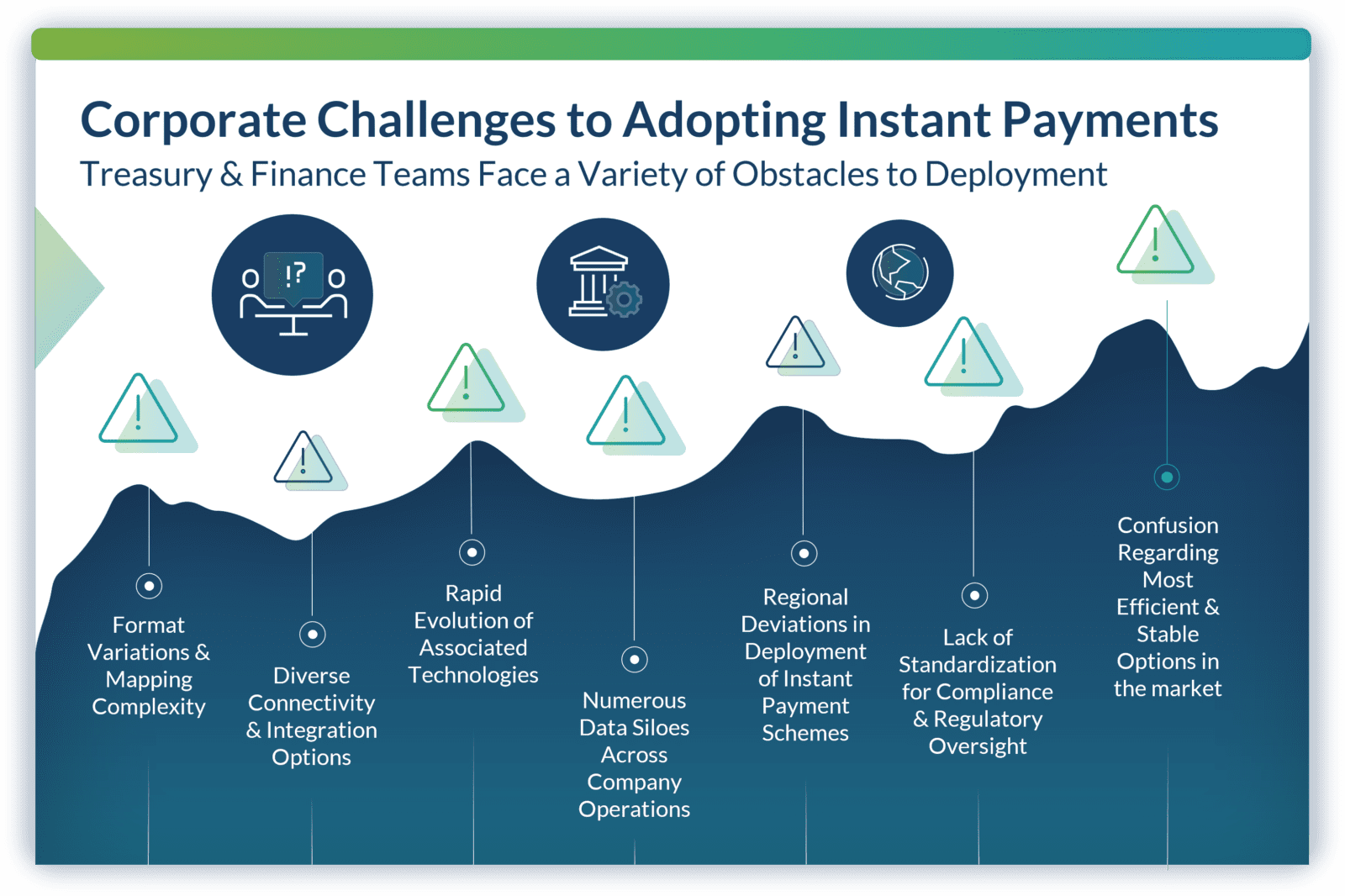

While the benefits of instant payments are evident, challenges arise concerning standardization and interoperability. Here you can find the main ones:

Format Variations & Mapping Complexity: The multitude of payment types, message formats, and variations within existing standards (such as ISO 20022), coupled with the need for global connectivity, necessitate solutions capable of navigating the complexities of this evolving landscape. Adding to this complexity is the Open Banking initiative with its APIs and the utilization of non-standardized JSON formats, making the adoption of instant payment instruments even more challenging. The financial industry traditionally utilizes XML for data interchange. However, the rise of Open Banking has pushed the JSON form to the payment landscape. This shift has resulted in a lack of standardization in data formats, with some financial institutions relying on XML, while others embrace JSON, or even a mixture of both JSON and XML. This disparity complicates interoperability and seamless integration between different systems.

Diverse Connectivity & Integration Options: The variety of connectivity options offered by each bank is another critical aspect. For example, many banks may offer their proprietary APIs for open banking, resulting in a diverse range of interfaces. The absence of a standardized API across financial institutions poses a challenge for corporations aiming to implement a universal solution for instant payments. Integration efforts become more complex, as each API requires tailored connectivity. Furthermore, the diversity of open banking APIs and JSON formats requires meticulous attention to security protocols. Corporations must ensure that when it comes to instant payment transactions (usually irrevocable) they maintain the highest level of security, especially when dealing with diverse connectivity standards and data structures.

Ongoing Evolution of Technologies & Regulatory Standards: Different regions, countries and jurisdictions may impose distinct regulatory requirements related to the new payment schemes. Corporations must navigate these regulatory nuances, adding an extra layer of complexity to the adoption of instant payments. At the same time, because current technology is evolving so rapidly, instant payment schemes (and the channels used to leverage them) are under a constant state of flux, which makes an enterprise’s or institution’s task of building an infrastructure to accommodate them much more difficult.

Internal (Company) Data Silos: Data silos within organizations pose challenges for interoperability and integration of instant bank payments. For example, different teams, such as HR, Finance, and Administration use various tools for information storage and task execution. The lack of interoperability between these systems and their connection to banking solutions creates difficulties in transitioning to instant payment processing. In addition, these silos lead to delays, errors, and inefficiencies in the payment processing.

TIS: A Strategic Solution for Global Challenges

Harmonizing Global Payments & Connectivity Workflows for Treasury & Finance

As countries worldwide adopt diverse instant payment schemes, the need for harmonization and interoperability increases enormously. Treasury Intelligence Solutions (TIS) emerges as a strategic player in navigating this global landscape. By providing solutions that streamline payment format standardization, enhance global connectivity, improve security, and adapt to the ever-evolving payment landscape. TIS enables businesses to thrive in a world where instant transactions are becoming the norm. Today, TIS acts as a crucial player in solving the challenges associated with the global move towards real time payments, faster payments, and instant payments, addressing the most pressing and complex issues, like:

Format Standardization: As financial landscapes transition to ISO 20022 standards, TIS provides a comprehensive solution for large corporates, ensuring compatibility with various banks and branches worldwide. The platform facilitates a seamless transition to standardised and non-standardised formats, promoting interoperability between diverse systems.

Enabling Global Connectivity: TIS’ innovative cloud platform serves as a global connector, which connects seamlessly with diverse systems and banks, enabling businesses to navigate the complexities of instant payments across complex ecosystems. This eliminates the need for extensive IT projects and adjustments, ensuring a smooth transition to real-time transactions.

Adapting to Change: TIS empowers businesses to adapt to evolving payment landscapes. Whether supporting global initiatives like SwiftGPI or addressing specific local payment requirements of individual countries, the platform’s agility ensures that businesses can embrace the advantages of instant payments without compromising on efficiency and legal compliance.

Breaking Down Data Silos: In the context of instant bank payments, TIS addresses the challenges posed by data silos by easily integrating with various source / back-office / banking systems and fostering interoperability. The platform swiftly consumes and centralizes information from various sources, standardizes it, and helps organizations in complying with new payment standards. This centralized approach empowers large corporates to effortlessly navigate the complexities of real-time payments and achieve seamless transition to modern payment standards.

Looking Ahead: A Unified Future

In today’s digitally connected global economy, the convergence of instant payment schemes worldwide reflects a shared vision for a future where financial transactions are seamless, secure, 24/7 and instantaneous. As businesses embrace the innovations introduced by platforms like TIS, they position themselves not just to adapt to change but to lead in an era where borders no longer limit the speed and efficiency of financial transactions. By leveraging the cutting-edge, cloud-based infrastructure offered by the TIS product, corporates gain the strategic advantage of scalability and flexibility. This means that they can expand their operations, processes, and capabilities to meet the demands of the future and more effectively navigate the challenges that lie ahead.