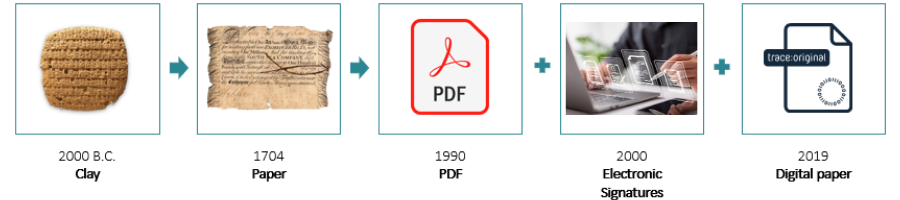

The Evolution of Legal Documents, The Next Step

22-02-2022 | Wim Kok | treasuryXL | LinkedIn |

A fantastic end-to-end digital journey has begun to create a paperless supply chain ecosystem for the benefit of all parties concerned in the documentary (paper heavy) Supply Chain settlements of today.

EVOLUTION OF LEGAL DOCUMENTS, THE NEXT STEP

For this Enigo AB (www.Enigio.com) started at the basis of the current standard, the paper document. A clean sheet of paper!

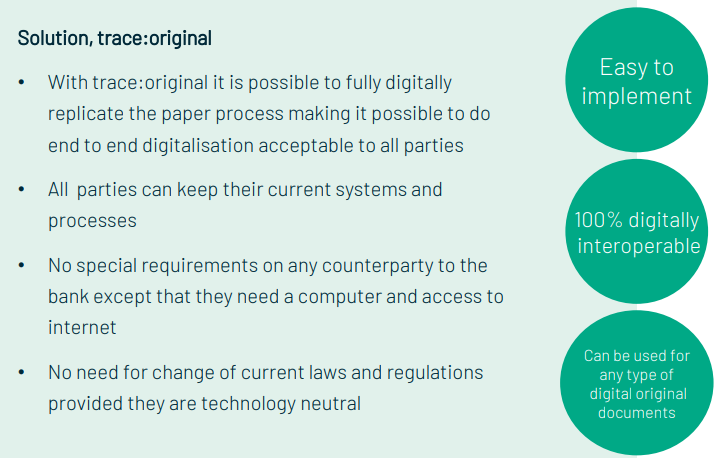

A large share of the communication in a trade finance transaction is already digitalised. Banks structure customer communication through portals, negotiate via safe e-mail and sign using e-signatures, not to forget SWIFT which has already enabled the digitalisation of many products and process steps between banks. A major obstacle for achieving a completely digital trade finance world has been the requirements to be able to manage and present documents in their original form. Enigio’s focus has therefore been to create a digital document with the same properties as its paper equivalent. The trace:original document is designed to be able to hold all necessary data to execute a transaction and at the same time not being tied to any specific transaction infrastructure. More importantly it can also be managed by anyone with access to a computer and the internet.

How does the solution work? Watch below video:

Following the accelerating momentum (after and pushed by the Covid pandemic), we see changing environment in the banking landscape, which is becoming rapidly more adoptive for transformation, especially digitalisation of the paper heavy trade documentation evidencing import- and export transactions. Both infrastructures, paper and digital documents must co-exist. There will be countries being early digital adopters and others lagging. An infrastructure agnostic digital trade finance document of any type can serve all the aspects of the global digital ambition extremely well. Interoperability can be achieved on different levels and by using different tools. One of the most forceful ways of achieving interoperability is by standardisation of data definitions and data formats. Json Schemas and the trace:original document is a perfect connector to achieve digital interoperability not only between blockchain based trade finance platforms but for all trade finance platforms.

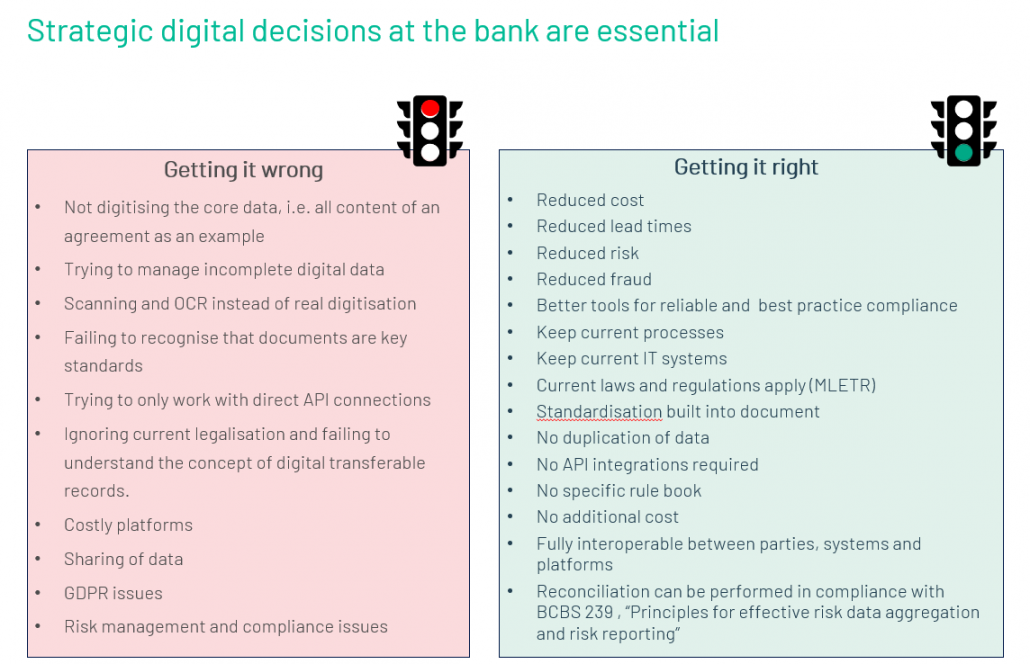

The banks’ lack of investment decisions for end-to-end digitised trade processes impacting their customers have created a large cost effect on corporations.

- Banks additionally impose costs on their corporate customers as they lack strategic vision on operative and compliance issues. Still manual or dual processes that are partly broken and very costly for all parties

- Banks also impose costs internally for front, middle and back-office and create compliance risks with manual or partly manual processes

- Trade finance digitalisation is a strategic issue for a bank and its corporate customers and is undergoing rapid change

- Many solutions and offerings to choose from but a lack of basic digital standards internally and when interacting with others

- Cost and risk/AML issues for all parties

- Bank’s role is to help to prioritise the trade finance short-term initiatives that will support corporate treasuries long-term objectives

- Banks should be firm with their opinion about coherent direction and help corporates to reduce the uncertainty that comes with trade finance digitalisation.

Conclusion

Footnote: further detail to be found on the website: www.Enigio.com

- Several whitepapers

- Walkthrough gallery of (1min.) YouTube videos explaining product usage very clear

- Modules for bank guarantees, Standby L/Cs, Prom Notes, Bills of Exchange and eB/Ls

Thank for reading and stay tuned!

International Business Consultant

Trade Finance Specialist