Trusted Payments

| 25-2-2019 | François de Witte | treasuryXL |

In any business transaction, there are risks. The Buyer wants to be sure to receive the goods or services before he makes the payment. On the other hand, the Seller wants to be sure to have his money before he releases the goods or deliver the services. The risks increase when the Buyer and the Seller are not within the same country.

In order to bridge this gap, for large overseas cross border transactions, the banks have developed specific services, such as the documentary credit, the documentary collection and the bank guarantees. Whilst these instruments prove to be reliable, they are quite expensive and paper-based, and hence are not suited for transactions of lower amounts or with small margins.

In my current company, SafeTrade Holdings, which deliver services linked to the domestic and cross-border sale of used vehicles, we were confronted with this problem, in particular for the cross-border sales of used vehicles.

At the start, the parties – who do not know each other – do not trust each other. The Seller wants to make sure to get the cash payment at the end of the sale. The Buyer wishes to avoid a risky cash transfer and ensure that the vehicle matches his expectations and that the payment will only be released once the car has been delivered.

Safe Trade has been looking for an innovative service aimed at ensuring payment security. We have discussed with various providers in the market and have found one smart solution, the trusted payment, developed by Digiteal, a FinTech which is also a Payment Institution recognized by the National Bank of Belgium.

How does it work

The trusted payment aims to establish a relationship of trust between two parties carrying out a financial transaction within the framework of a common project (used vehicle purchase-sale, real estate operation, etc.).

The process is initiated by the Seller or an Intermediary who will invite the Buyer to transfer the cash to a trusted account (segregated account), which can be compared to an electronic safe. The money can only be released once both Buyer and Seller confirm the success of the operation to release the money.

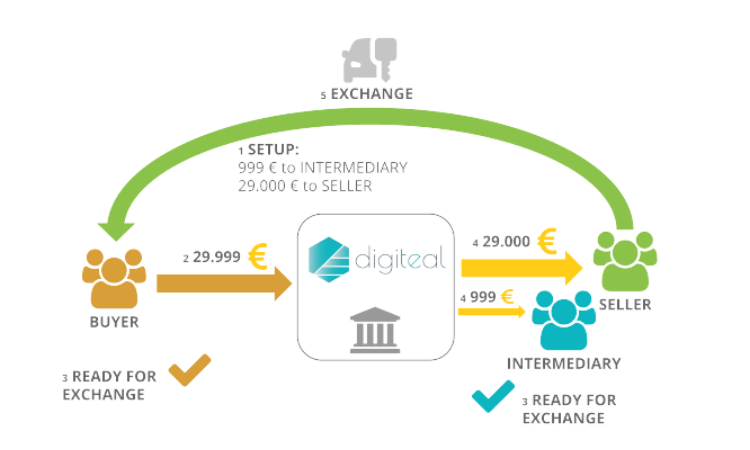

The stages of the transaction are the following:

- Account creation by the Buyer and the Seller. The Intermediary creates via the Digiteal application a request inviting the Buyer to pay the sale price in the trusted account. The Intermediary will bear the transaction cost.

- The Buyer pays the amount of the sales price to the trusted account. The Seller and the Intermediary are notified as soon as the money has arrived on Digiteal’s segregated account.

- The Seller, the Intermediary and the Buyer are ready for the exchange. The Buyer verifies the condition and conformity of the vehicle. The Buyer and the Seller validate the transaction through the Digiteal application

- Once validated, the sale price is released from Digiteal’s segregated account and transferred to the bank account of the Seller and to the one of the intermediary. The Seller receives the confirmation of the release of the funds in his favour and the money will be on his account within 2 working days at the latest.

- The Buyer leaves with the car.

Figure: Trusted Payment with split:

Benefits of the solution and next steps

The main benefits of the trusted payment solution are that it secures a sale transaction. Other benefits include:

- The fact the all processes are digital and can be processed on an intuitive mobile application

- There is a full KYC, but this is handled in a user-friendly way

- The trusted payment supports the split billing

- The amount to be released to the Seller can be amended.

- The pricing is competitive

The solution will be extended to other goods and services, where we are currently developing new use cases. We are also examining the possibility to provide alternatives to replace the signing process leading to the release of the funds. One could imagine that at the start of the transaction, the Buyer and the Seller agree on a specific set of documents which would trigger the release of the money through a Smart Contract. This could avoid litigation between the Buyer and the Seller.

François de Witte – Founder & Senior Consultant at FDW Consult; Managing Director and CFO at SafeTrade Holding S.A.

François de Witte – Founder & Senior Consultant at FDW Consult; Managing Director and CFO at SafeTrade Holding S.A.

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]