Italian general elections – the end of la dolce vita?

| 05-03-2018 | treasuryXL |

On Sunday 4th March 2018, Italy head to the polls. About 50 million people will vote for a new national government. They are looking to elect 630 members of the Chamber of Deputies and 315 members of the Senate of the Republic. A new electoral system will see 37% of seats allocated by a “first past the post system” and the remaining 63% allocated by proportional representation according to the largest remainder method. Political ideology is represented by more than 20 parties embracing the political range from communism to neo-fascism, together with 2 predetermined coalitions based on centre-left and centre right. One of the contestants is Silvio Berlusconi (representing the Forza Italia – the centre-right coalition) who is barred from holding public office until 2019 as a result of a tax fraud conviction! So what are the issues for the 3rd largest Euro-bloc country and what are the potential repercussions for the EU and the Euro?

On Sunday 4th March 2018, Italy head to the polls. About 50 million people will vote for a new national government. They are looking to elect 630 members of the Chamber of Deputies and 315 members of the Senate of the Republic. A new electoral system will see 37% of seats allocated by a “first past the post system” and the remaining 63% allocated by proportional representation according to the largest remainder method. Political ideology is represented by more than 20 parties embracing the political range from communism to neo-fascism, together with 2 predetermined coalitions based on centre-left and centre right. One of the contestants is Silvio Berlusconi (representing the Forza Italia – the centre-right coalition) who is barred from holding public office until 2019 as a result of a tax fraud conviction! So what are the issues for the 3rd largest Euro-bloc country and what are the potential repercussions for the EU and the Euro?

The main issues appear to be the economy and immigration. The arrival of more than half a million immigrants since 2013 has upset many Italians and led to politicians increasing their rhetoric on the subject. Mr. Berlusconi has concluded that immigration is a social time bomb and has advocated a policy of mass deportation. His comments are shared by many other political parties – though not all. Electoral manifestos have included such populist tracts as increasing the minimum wage and tax allowances, reduction in income and corporate tax, increase spending on public welfare and, ambitiously and without detail, a reduction in sovereign debt by 40 percentage points in relation to GDP within the next 10 years.

Italian economy

Italy has seen a faltering economy over the last 10 years. Their annual GDP growth rate has rarely exceeded 2% per year in that time. Industrial output is still 5% lower than before the crisis. This is in stark contrast to their peers in Europe who have mainly all recovered and now have industrial output higher than before the crisis. Reforms have seen more than 1 million jobs created since 2014, but more than 60% of these are part-time jobs. Unemployment has fallen but the rate of unemployment is still over 11%. One third of Italians aged between 25 and 29 remain unemployed.

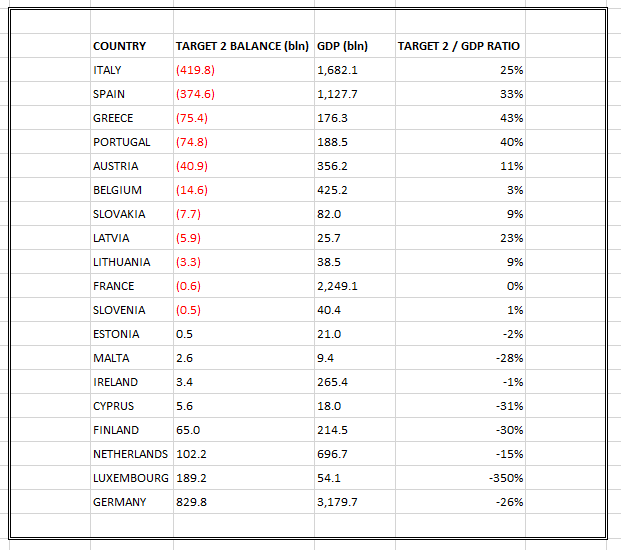

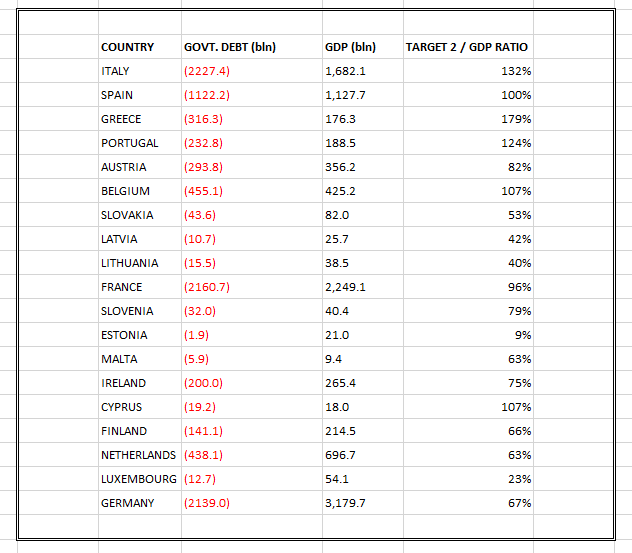

Sovereign debt has increased over the last 10 years. Outstanding debt now exceeds EU 2.2 trillion and the ratio of debt to GDP is over 130%. The banking sector is also affected. More than 15% of all loans to businesses and consumers are now recognised as non-performing loans. Additionally, at the end of 2017, Italian outstanding debt arising from Target2 balances was approaching EUR 440 billion.

So, Italy has the 2nd largest debt to GDP ratio in the EU, largest ratio of bad debts at commercial banks and the largest outstanding negative balance at Target2. The only sensible way to prevent the levels of debt from becoming unsustainable would be for the Italian economy to grow faster that their historical average – a well-meaning definition, but one that looks very remote in the present economic and political climate.

Italian politicians have increased their anti-EU rhetoric recently, stating that the current situation cannot continue – both economically and in relation to the number of immigrants. How they think the EU will change at a time that they are facing more internal pressure from dissatisfied member states is a mystery.

First results should arrive around lunchtime on Monday 5th March 2018 – only then will we know what the future holds for Italy, the EU and the Euro.

The image of Italy, for some, is of La Dolce Vita as seen in the famous film of 1960 by Federico Fellini. The vision of Anita Ekberg in the Trevi fountain – once seen, never forgotten.

But the moral of the story was the unsuccessful pursuit of love and happiness.