Option Tales: Cheap Options Part I

17-05-2016 | By Rob Soentken |

Today in Rob Soentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which will be discussed in four articles. Today I’m discussing the first two solutions: Choose the strike further OTM and Choose shorter tenor.

1-Choose Out of The Money (OTM) Strike

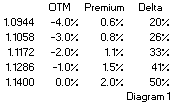

Hedging the purchase of a certain amount of USD could be done by purchasing a USD call option with the strike set At The Money (ATM). In diagram 1 it shows that such an option would costs about 2.0%. The strike is 0% OTM, so ATM. A strike further OTM would cost less premium. For example, a strike set at 3% OTM would costs only 0.8%. The cost saving is 1.2%, but also the protection kicks-in only after USD has appreciated by 3%.  Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option.

Should we need to exercise the option to get our USD, it still means a combined hedging cost of 3.8%. Which is more than if we had bought the ATM option for 2% premium. Conclusion: Buying an OTM option reduces the up-front cost versus buying an ATM option. But ex-post hedging with an OTM option could result in total hedging cost which are higher than an ATM option.

2- Choose shorter tenor

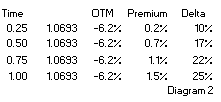

Hedging the purchase of a certain amount of USD in 1-year time could be done by purchasing a USD call option with 25% chance of exercise. In diagram 2 it shows that such an option would have a strike 6.2% OTM and would cost 1.5%. Options with the same strike but with a shorter tenor would cost less up front. For example: choosing a 3-month time to expiry would make the option premium 0.2%. It must be noted that while the 3-month option has the same strike as the 12-month, its chance on exercise (Delta) is substantially less. By itself choosing a 3-month tenor is not ‘wrong’ when hedging a 12 months USD flow. It is just the on the expiry date of the option either the  option is exercised, or the USD must be purchased from the market at the prevailing rate.

option is exercised, or the USD must be purchased from the market at the prevailing rate.

In my next two articles I will discuss the following solutions for minimizing premium expenses when buying options:

- Choose longer tenor

- Average rate option

- Conditional Premium option

- Reverse Knock Out

Want to read more in Rob Soentken’s Option Tales?

Option Tales – Options are for Wimps

Options Tales – ATM OR OTM?

Ex derivates trader