Interest payments – How to calculate the days

| 07-03-2018 | Lionel Pavey | treasuryXL | LinkedIn

When entering into a financial transaction you need to be aware of the settlement dates. If you have a contract that states that you must pay on the 1st day of every month what do you do when that date is a non-working day? Furthermore, to be able to calculate the interest owed on a loan, you also need to know what the denominator is – the number of days in a year for the particular product and contract. When a payment cannot take place on a particular date – because it is not a recognised business day, you need to know the convention that the bank uses to adjust the payment date. Here is an overview of the most commonly used business day conventions (which determine how non-business days are handled) and calculation bases.

When entering into a financial transaction you need to be aware of the settlement dates. If you have a contract that states that you must pay on the 1st day of every month what do you do when that date is a non-working day? Furthermore, to be able to calculate the interest owed on a loan, you also need to know what the denominator is – the number of days in a year for the particular product and contract. When a payment cannot take place on a particular date – because it is not a recognised business day, you need to know the convention that the bank uses to adjust the payment date. Here is an overview of the most commonly used business day conventions (which determine how non-business days are handled) and calculation bases.

Business day conventions | Modified Following

Preceding – the first preceding day that is a business day

Following – the first following day that is a business day

Modified Following – the first following day that is a business day, unless the days falls in the next calendar month, in which case the date will be the first preceding day that is a business day

Furthermore reference will be made to the applicable currency calendar for determining non-working days. For EUR this would mean TARGET, for GBP this would mean London, for euro USD this would mean London and New York.

Calculation basis

Actual/360 (Money Market) – the coupon payment is calculated using the exact number of days in the period divided by 360. The start date is included in the calculation, but not the last day.

Actual/365 (Fixed) – the coupon payment is calculated using the exact number of days in the period divided by 365. The start date is included in the calculation, but not the last day

Actual/Actual (ISDA) – the coupon payment is calculated using the exact number of days, with the portion of days belonging in a non-leap year divided by 365 and the portion of days belonging in a leap year divided by 366. The start date is included in the calculation, but not the last day.

Actual/Actual (ISMA) – the coupon payment is calculated using the exact number of days divided by the length of the year, where the length of the year is equal to the number of days in the coupon period multiplied by the number of coupon periods in the year.

30/360 (Bond basis) – the coupon is calculated over 30 days for every full calendar month and the actual number of days for the remaining fraction of a month, divided by 360.

30/360E (Eurobond basis) – the coupon is calculated on the basis of a year of 360 days with 12 30-day months, unless the end date is the last day of February, which is not lengthened to a 30-day month.

Coupon calculation conventions

Adjusted – Interest is calculated on the effective payment date adjusted for the business day

Unadjusted – Interest is calculated on the theoretical payment date, regardless of the effective payment date.

If you are interested to know what the effect of these changes can be on a coupon payment and calculation, please contact us for more detailed information.

Cash Management and Treasury Specialist

It is the talk of the town – US 10 year Government bond yields are rising and testing the perceived psychological level of 3 per cent. At the same time the whole yield curve is flattening – the spreads are diminishing. There are growing concerns about rising inflation, along with fears of trade wars and rising oil prices. When the threat of inflation occurs, there is a selloff in bonds and their yield goes higher. At the same time as the yield curve is flattening there is talk of the yield curve becoming inverted which, historically, is seen as the precursor to a recession. Conflicting signals – what does it all mean?

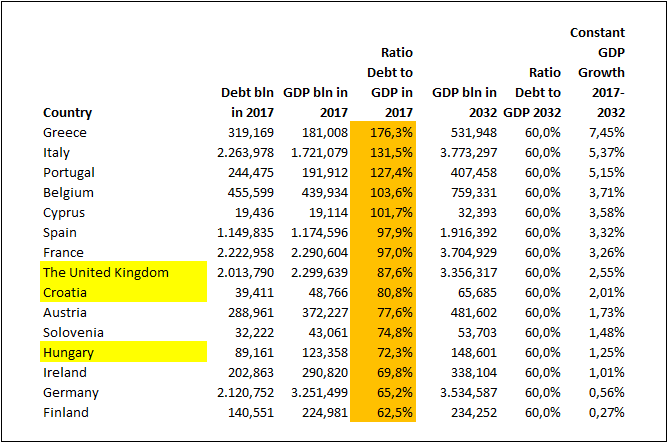

It is the talk of the town – US 10 year Government bond yields are rising and testing the perceived psychological level of 3 per cent. At the same time the whole yield curve is flattening – the spreads are diminishing. There are growing concerns about rising inflation, along with fears of trade wars and rising oil prices. When the threat of inflation occurs, there is a selloff in bonds and their yield goes higher. At the same time as the yield curve is flattening there is talk of the yield curve becoming inverted which, historically, is seen as the precursor to a recession. Conflicting signals – what does it all mean? A few weeks ago the EU Commission released a report on debt sustainability within the EU. It provides an overview of the challenges faced by member countries over the short, medium and long term to meet the original convergence criteria – specifically, that existing Government debt is less than 60% of GDP. As with most Government related documents it is long – over 250 pages. A lot of attention is drawn to the Debt Sustainability Monitor (DSM) and the challenges faced to achieve the abovementioned criteria by 2032.

A few weeks ago the EU Commission released a report on debt sustainability within the EU. It provides an overview of the challenges faced by member countries over the short, medium and long term to meet the original convergence criteria – specifically, that existing Government debt is less than 60% of GDP. As with most Government related documents it is long – over 250 pages. A lot of attention is drawn to the Debt Sustainability Monitor (DSM) and the challenges faced to achieve the abovementioned criteria by 2032.

Since the beginning of February there has seen large declines in all the major stock markets – Dow Jones down 9%, AEX down 7%, DAX down 7%, FTSE down 5%. The major reason given is that the market has been disturbed by the thought that interest rates in the US will rise more quickly than previously expected as prospects of inflation come to the fore. Going counter to this thought is the explanation that stock markets achieved good growth in 2017 – all major markets were up with some growing by 15% – and that this is a bout of profit taking, before participants will buy on the dip.

Since the beginning of February there has seen large declines in all the major stock markets – Dow Jones down 9%, AEX down 7%, DAX down 7%, FTSE down 5%. The major reason given is that the market has been disturbed by the thought that interest rates in the US will rise more quickly than previously expected as prospects of inflation come to the fore. Going counter to this thought is the explanation that stock markets achieved good growth in 2017 – all major markets were up with some growing by 15% – and that this is a bout of profit taking, before participants will buy on the dip. At the moment headline inflation is remaining stable, but it appears that the market is expecting inflation to move higher in 2018. The increase in the yield of US 10 year Treasury rates has been more rapid than expected – at the moment the yield is almost 2.90%. It would appear that the increase in US rates is pulling other currency yields higher. Furthermore rises in US interest rates will have an impact on FX hedging policies for companies.

At the moment headline inflation is remaining stable, but it appears that the market is expecting inflation to move higher in 2018. The increase in the yield of US 10 year Treasury rates has been more rapid than expected – at the moment the yield is almost 2.90%. It would appear that the increase in US rates is pulling other currency yields higher. Furthermore rises in US interest rates will have an impact on FX hedging policies for companies. Over the last year there have been impressive price gains in Greek Government bonds leading to equally impressive falls in yields. Greek 2-year bonds are now yielding 1.35% – down from around 7% at the start of 2017. Similarly, 10-year bonds are now yielding 3.66% – a significant fall since the start of 2017. In fact, the yield on Greek 2-year bonds is now lower than in USA where the current yield is 2.09%. Last week S&P upgraded Greece’s long term credit rating to ‘B’ from ‘B-‘. It would appear that Greece is doing everything right. Right?

Over the last year there have been impressive price gains in Greek Government bonds leading to equally impressive falls in yields. Greek 2-year bonds are now yielding 1.35% – down from around 7% at the start of 2017. Similarly, 10-year bonds are now yielding 3.66% – a significant fall since the start of 2017. In fact, the yield on Greek 2-year bonds is now lower than in USA where the current yield is 2.09%. Last week S&P upgraded Greece’s long term credit rating to ‘B’ from ‘B-‘. It would appear that Greece is doing everything right. Right?

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. Today our expert François de Witte will explain de difference between long term and short term debt.

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. Today our expert François de Witte will explain de difference between long term and short term debt. François de Witte – Founder & Senior Consultant at

François de Witte – Founder & Senior Consultant at